Accessing the FX Trade Blotter

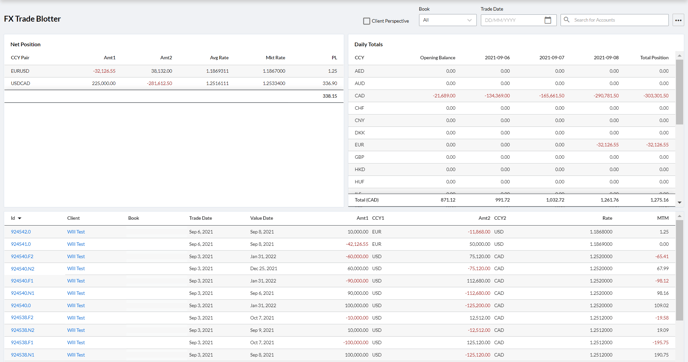

The FX Trade Blotter (accessed via FX Blotters → FX Trade Blotter in the navigation panel) shows the details of all FX trades executed in the system on a line-by-line basis.

Filters

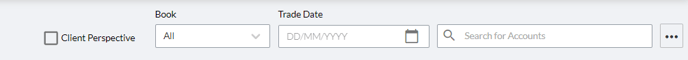

Filters are available in the top-right corner of the FX Trade Blotter page allowing you to:

-

View the trade details from the client’s perspective (checkbox)

-

Filter the blotter for only trades in a particular book

-

Filter the blotter for only trades executed on a particular date

-

Filter the blotter for only trades executed by a specified account

Blotter Views

The FX Trade Blotter contains three views, or cards, for summarising the information. These are:

-

The Net Position card

-

The Daily Totals card

-

The Open Trades card

Net Position

The Net Position card in the top-left of the blotter summarise the currency pairs traded, showing the net amount across all trades executed against that pair. For each currency pair traded, the Net Position card shows:

-

Net volumes traded in the currency pair

-

The average rate at which the trades in the currency pair were executed

-

The current market rate for the currency pair

-

The unrealised P&L from the net position

Daily Totals

The Daily Totals card in the top-right of the blotter displays the daily total of each currency traded for the past three days. These daily totals are converted into the entity base currency and shown at the bottom of the card (in the above example it's shown as Total (CAD).

Open Trades

The Open trades card at the bottom of the blotter displays information about open trades that meet the filter criteria. The details of each trade are included on their own line in the blotter and include:

-

The trade ID

-

Client the trade was executed against

-

Book the trade was assigned to

-

Trade date

-

Value date

-

Currency 1 and associated trade notional

-

Currency 2 and associated trade notional

-

Rate the trade was executed at

-

Mark-to-Market (MTM) valuation of the trade